|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Cash Out Refi Investment Property Lender: Expert Tips and AdviceIn the world of real estate investment, a cash-out refinance can be a powerful tool. This process allows property owners to refinance their existing mortgage, pulling out equity as cash for various investment opportunities. Understanding Cash-Out RefinanceA cash-out refinance involves replacing your existing mortgage with a new one, often at a lower interest rate, while extracting a portion of your property's equity. This method is commonly used by investors to fund renovations, purchase additional properties, or consolidate debt. Benefits of Cash-Out Refinancing

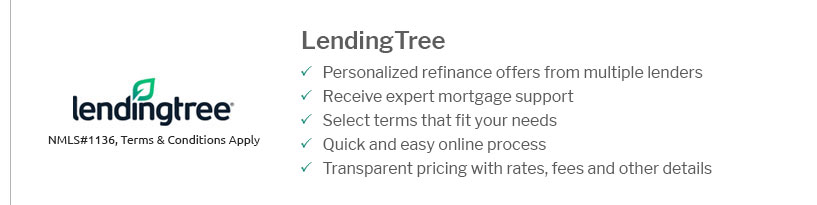

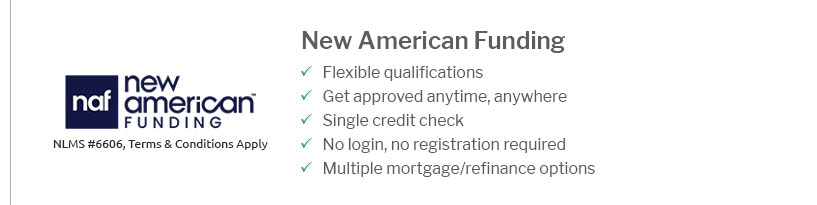

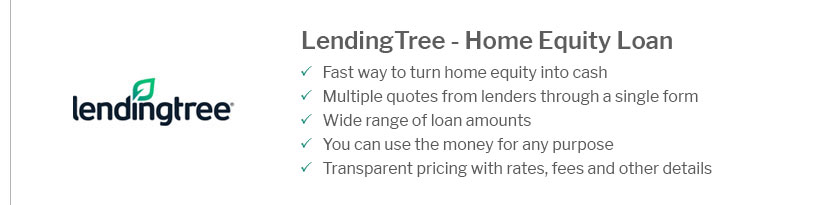

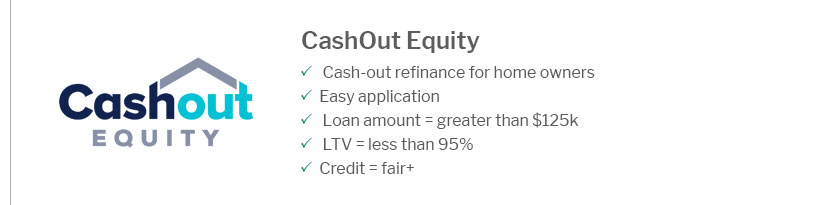

For more detailed insight into refinancing options, you can explore can i refinance my home loan. Choosing the Right LenderSelecting the right lender is crucial for a successful cash-out refinance. Here's what to consider: Lender Criteria

It's essential to evaluate different lenders to find the best fit for your specific needs. Common Challenges and How to Overcome ThemWhile cash-out refinancing is beneficial, it comes with challenges. Investors must be prepared to address these issues effectively. Overcoming Appraisal IssuesAn accurate property appraisal is vital. If your property's value doesn't meet expectations, consider improving the property's condition or reassessing the market before applying again. Managing Debt-to-Income RatioYour debt-to-income ratio plays a significant role in loan approval. Maintain a healthy ratio by managing existing debts efficiently. For those considering unique property types, can i refinance my mobile home might offer valuable insights. Frequently Asked QuestionsWhat is the minimum credit score required for a cash-out refinance on an investment property?Typically, lenders require a minimum credit score of 620, but a higher score may provide better rates and terms. How much equity can I cash out from my investment property?Lenders usually allow you to cash out up to 75% of the property's appraised value, depending on the lender's policies and your financial profile. Are there any restrictions on how I use the cash from a refinance?No, you can use the funds for any purpose, such as reinvesting in real estate, renovating properties, or consolidating debt. In conclusion, navigating a cash-out refinance for investment properties requires careful planning and the right partnerships. By understanding the process and choosing a suitable lender, investors can unlock the potential of their real estate assets. https://www.credible.com/mortgage/cash-out-refinance-investment-property

A cash-out refinance allows you to replace your current mortgage on an investment property with a new loan that's larger than the existing ... https://www.fairway.com/articles/how-to-get-a-cash-out-refinance-on-an-investment-property

A cash-out refinance can free up funds to upgrade the property or put a down payment on another investment. https://ahlend.com/refinance-loans/

American Heritage Lending is a direct lender providing cash-out refinance loans to real estate investors and property owners.

|

|---|